Almost 3.2 million Australians (14+) eat a packaged dairy dessert such as a custard, mousse, chocolate pudding, creamy rice or fruity whip in an average four weeks, but maybe not necessarily for dessert, Roy Morgan Research said.

According to a Dairy Australia’s 2014 focus report, dairy desserts are a low volume/high value dairy category with slowly declining volumes in recent years, while yoghurt sales to grocery, convenience and wholesale channels have fallen since 2012-13.

“Eaten by around 1 in 25 Australians in an average four weeks, Dairy Farmers Custard is one of the most popular products across all age groups. As the latest Roy Morgan Research data shows, our taste for other ready-to-gobble dairy treats on the market changes with age,” Roy Morgan Research said.

Frûche is the only other product to make the top five across all ages, rising with age to peak at number two among the 50+ age group.

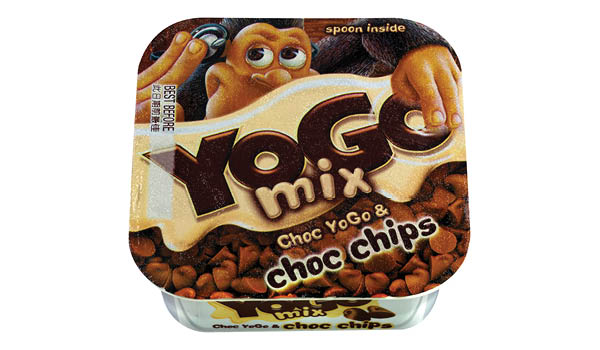

Conversely, the YoGo range and Nestlé Milo are most popular products among the Under 25s, but decline and fall out of the top five altogether, as we get older.

Nestlé Mousse jumps from nowhere to be the top pick among 25-34 year-olds but is replaced at the top by Dairy Farmers Custard in both groups over 35. Only among the Over 50s do Yoplait Le Rice and Divine Classic Crème Caramel make an appearance.

Angela Smith, group account director – Consumer Products, Roy Morgan Research, said: “With so many dairy dessert snack options on supermarket shelves, including an increasing array of smaller niche products, brands must differentiate themselves by pinpointing who eats them, how often, and who is their household’s main grocery buyer.

“Check-out monitoring and targeted market research are clearly not enough.”