Woolworths Supermarkets’ recent announcement that they were reducing the price of their Homebrand white bread from $1 to 85c a loaf not only attracted widespread media attention, but prompted Coles and ALDI to match the price with their equivalent ‘store’s own’ white loaves. Will these ‘bread wars’ impact smaller specialist stores such as Bakers Delight? The latest data from Roy Morgan Research suggests not. On the contrary, Roy Morgan Research says that market share remains fairly stable for both supermarkets and specialist stores.

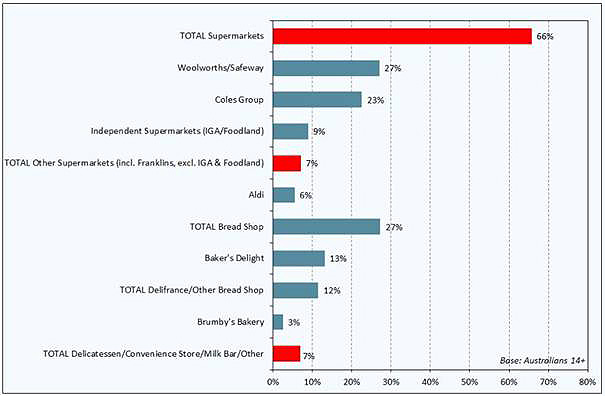

Of the supermarkets, Woolworths already has the largest share of the bread market, accounting for 27% of total dollars spent on bread in an average week, with a mean weekly spend per customer of $6.00. Coles Group is second with a 23% share and mean weekly spend of $5.70, well ahead of IGA (7%) and ALDI (6%). Overall, supermarkets account for almost two-thirds of Australia’s total weekly bread spend.

At convenience and impulse stores, the weekly spend by shoppers who buy their bread there is $6.90. But bread sales at these smaller stores have been in serious decline for many years.

Warren Reid, Group Account Director for Morgan Research told C&I WEEK that there were some specific touch points for convenience and impulse retailers arising from their research.

“During the last 12 years, the share of bread sales made at convenience and impulse outlets, such as convenience stores, milk bars, corner stores, delis and so on, has dropped from 9.3% to 6.9%,” Mr Reid said. “The petrol and convenience share of bread sales has fared rather worse, dropping from 1.3% to 0.6% over the same period. Corner stores have suffered in particular, with their bread share dropping from 1.7% to just 0.6%, perhaps because there are now a lot fewer of them.

“Our figures indicate that there are two groups who tend to be much more likely to buy bread from a convenience or local store. They live in major metro areas and are the cashed up and single under-25s or older the better-off people in the 50-64 age group. These groups are 67% more likely to buy bread from these outlets than are the rest of the population.

“These customers like to entertain, tend to spend more on bread and are particularly brand loyal as well as quality conscious. In fact, they are quite distrustful of brands they don’t know and share much of their bread purchases between impulse and convenience outlets and specialty bread shops.”

The take home message may be that convenience and impulse stores in metropolitan areas might like to concentrate of the quality of their bread offer rather than trying to compete on price.